Tax. It’s the dreaded word. We won’t get into the old saying about certainties – you understand where we’re coming from already.

Like it or not, it’s something that we all have to put up with. For a small business owner, it can be particularly tedious though. It’s an additional form of paperwork, when you already seem to be performing every single job alone.

Today’s post is all about simplifying matters. Let’s now dive into seven tips that can help you to stay on top of your affairs, whilst still managing to grow and maintain your business.

1. Understand everything you can about allowable expenses

The first step is to understand everything you can about allowable expenses. These are the costs that you can claim back from the government, in order to reduce your overall tax bill.

Some of the most common include office costs, travel (including fuel) and even insurance like these here. However, there are many more that are often overlooked. For example, did you know that you can claim for the cost of your home computer and internet connection, if you use it for business purposes?

There are of course all sorts of caveats with the above, but by doing all this research in good time, you can not only stay on top of your tax affairs – but also save money for your business. This ‘saving’ element is something that many business owners just don’t full appreciate and ultimately, take advantage of.

2. Use an accountant

Following on from the previous point, this may seem like an obvious one, but it’s often overlooked. An accountant can be an absolute godsend for a small business owner.

They can take care of all of your paperwork, leaving you free to focus on running and growing your company. They can also offer invaluable advice on tax matters (see above!), and can even help you to save money in the long run.

Of course, there are costs associated with using an accountant. However, in our opinion, the peace of mind and extra time that they can provide is more than worth it.

3. Keep good records

This is another important one. You need to make sure that you keep good records of all of your income and expenditure. This will make it much easier to complete your tax return and will also help to prevent any nasty surprises further down the line.

There are all sorts of ways to do this, but we recommend using some sort of accounting software. This will make it easy to track everything in one place and will also save you a lot of time and hassle in the long run.

4. Stay up to date

It’s also important to stay up to date with all the latest tax changes. The government is always introducing new rules and regulations, so it’s important to keep on top of them. Not all of these are detrimental to you either; one only has to look at the recent capital allowance expenses to see this in its full glory.

Of course, the opposite can also occur, and this can naturally be even more dangerous. After all, if you’re forecasting to deal with one rate of tax, but you’re actually going to be paying a higher rate, it can result in all sorts of unwanted repercussions. One could argue that the recent changes to the tax brackets, which are going to be frozen for the next few years, falls into such a category.

If you’re not using an accountant, the best way to do this is to sign up for a tax newsletter, or to follow a reputable tax blog. This will ensure that you’re always in the loop, and that you can take action accordingly.

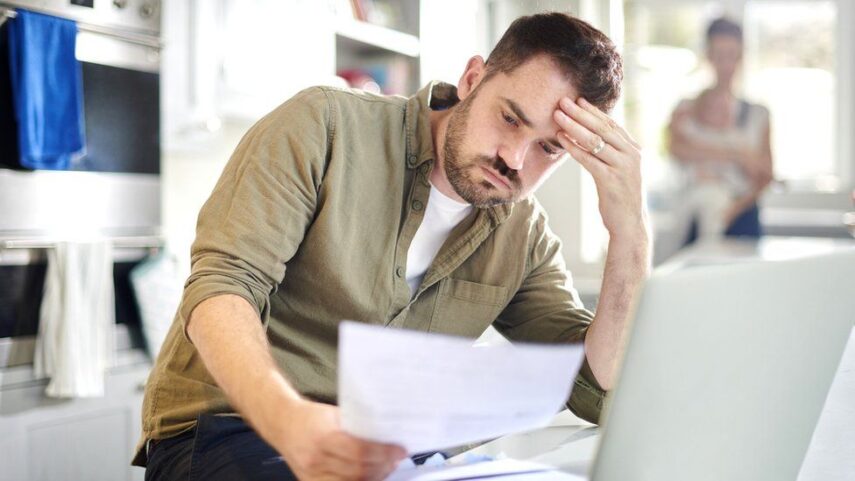

5. Don’t leave it until the last minute

This is a big one. It can be tempting to leave your tax affairs until the last minute, but this is definitely not advisable. Not only will it cause you a lot of unnecessary stress, but it also increases the likelihood of mistakes being made.

The dates can vary slightly depending on your organizational structure but generally speaking, for most readers out there, you’ll have until the end of January to both file your returns and pay them. The payment element is obviously crucial here; leave it until the last day to submit your return and you’ve also got to scurry around and find the necessary money to avoid a late-payment fine. In other words, submit your return weeks, or preferably months in advance, leaving yourself a clear window at the end of January to make the payment.

It’s much better to stay on top of things from the outset. This way, you can be sure that everything is in order and that you’re not going to miss any important deadlines.

6. Use technology

We’ve already touched upon this briefly, but we really cannot emphasize the importance of technology. As well as the standard software which can help you track expenses, there are also all-singing, all-dancing apps that can cover absolutely everything related to your tax affairs. Some will even almost submit your return for you.

Put simply, tax doesn’t revolve around manual pen and paperwork that it was historically known for. Yes, there will be work on your part, but if you choose your tools wisely, you can cut down on this significantly.

7. Get help if you need it

Finally, if you’re struggling to stay on top of your tax affairs, don’t be afraid to ask for help. There are many organizations out there that can offer assistance, so make sure to take advantage of them if you need to.

Your accountant should be your first port of call, but you can also get help from the government’s HMRC website, or from one of the many tax helplines that are available.

In conclusion, staying on top of your tax affairs doesn’t have to be a nightmare. By following the tips above, you can make the whole process a lot easier and less stressful.